- Office Hours: Mon - Sat 10.00 am - 06.00 pm

- Atharva Group Since 2009

Updates

Registration of Organization Under Govt. Act

Registration Of Organization Under Govt. Act

Tax Registration

Registration under the Section 12AB Income Tax Act allows the Non Profit Organization an exemption from tax rates.

Section 80G of Income Tax Act, 1961 for donations made to a charitable organization or a trust

The Goods And Services Tax (GST) Registration for Supplying Goods and Services, under The Central Goods and Service Tax Act, 2017

The Bihar tax on professions, Trades, Callings and Employment Act, 2011

Permanent Account Number under Section 139A of the Income-tax Act, 1961, prescribes various conditions under which an assessee is required to obtain PAN.

As per section 203A of the Income-tax Act, 1961, every person who deducts or collects tax at source has to apply for the allotment of TAN

10 (23C) under Income Tax Ac:- Section 10(23C)(iiiad) provides that the income earned by any university or educational institution shall be exempt from tax if the aggregate annual receipts of such university or educational institution do not exceed Rs. 5 crore.

Registration of Organization under Various Act of Government for different purposes

Charitable Trusts, Societies, Section 8 Company that receive foreign contribution or donation from foreign sources are required to obtain registration under Section 6(1) of Foreign Contribution Regulation Act, 2010. Such a registration under the Foreign Contribution Regulation Act, 2010 is called a FCRA registration.

NITI Aayog invites all Voluntary Organizations (VOs)/ Non-Governmental Organizations (NGOs) to Sign Up on the Portal. The Portal facilitates VOs/NGOs to obtain a system generated Unique ID, as and when signed. The Unique ID is mandatory to apply for grants under various schemes of Ministries/Departments/Governments Bodies.

(The Employee Provident Funds and Miscellaneous Provision Act 1952 ) Employee Provident Fund Registration is a mandatory requirement for all organisations that have more than 20 employees.

(The Employee State Insurance Corporation Act -1948) Any company or institution that has more than a minimum amount of employees would have to go for the process of ESIC Registration. ESIC is an abbreviation for Employees State Insurance Corporation

MSME is an abbreviation for Micro, Small and Medium Enterprises. This sector represents a major portion of the Indian economy.

Mandatory Registration of NGO with Ministry of Corporate Affair for Getting CSR Funding

Director Identification Number is also known as DIN Number is a unique identification 8 digit number that is required for any existing Director of a Corporation as per Companies Amendment Act, 2006.

Digital Signature Certificates (DSC) are the digital equivalent (that is electronic format) of physical or paper certificates. Electronic documents, for example e-forms are required to be signed digitally using a Digital Signature Certificate.

Patent Registration helps in protecting inventions while invention must be novel, unique and innovative.

Every business owner dealing in food products has to secure the FSSAI License from the relevant authority

Any contractor engaging 20 or more contract Workers is required to get license. Object: The object of the Act is to regulate the employment of contract labour in certain establishments and provide for its abolition in certain circumstances and for matters connected therewith.

Bihar Shops & Establishments Rules, 1995. The Shop and Establishment Act is regulated by the Labour Department of the respective states.

Government E-Marketplace or GeM is a portal to facilitate online procurement of goods and services required by various government departments, organizations and public sector undertakings in India.

- Brand Listing

- Product Listing &

- Category Listing.

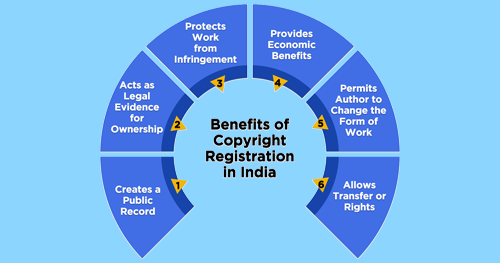

Copyright registration provides protection to the intellectual work of owner & ensures that originality is honored.

A Trademark Registration in India helps in brand recognition, goodwill building, and customer retention for any business.

Chat with Us

Chat with Us